Finance in the Netherlands

When you move to a new country understanding your money management options can be a challenge. Good think is that most banks and companies dedicated to help you with your money management offer services in English. From opening a bank account to insuring your family’s home and belongings, it’s important you know which options are right for you. In this section we explore Finance in The Netherlands.

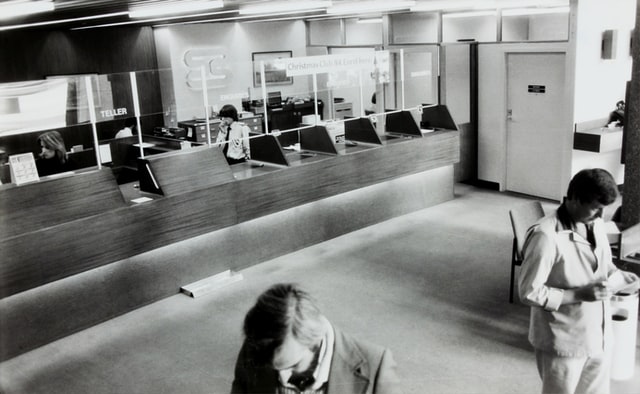

Banking in the Netherlands

To receive your salary and pay expenses such as rent and electricity you need to open a bank account. You can go to a bank in person, but the majority of banks in the Netherlands offer services electronically.

bunq - bank of The Free

Moving to The Netherlands and need a new bank account? Open a bunq account without all the hassle and start banking in just 5 minutes.

Pension system in the Netherlands

The Dutch pension system is based on three pillars: AOW (state pension), providing a basic income for retirees, the longer you lived in the Netherlands, the more you get. Occupational pensions, where employers and employees contribute to a collective pension fund; and your private savings, for additional retirement income.